Hi,

Welcome

to yourfeedbackreviews.com, today I want to shed more light on forex trading

strategies designed for both beginners and professionals alike. So, what is the

best strategy for forex trading? What are the best forex trading strategies for

beginners?

These

are questions I asked when I was just starting out as a new forex trader many

years ago. Today, I still see people asking these same questions -- which are why I

decided to write about it. It

is paramount to note that before you talked about having better trading

strategy you need to first understand some basic things about forex trading. And

that's what this article is all about. To show you what you need to learn in

order for you to become a better trading.

The

base of what I want you to note here is that you need to know and understand

yourself better before you can start talking about been a better and profitable

trader. What am I talking about here?

I'm

talking about understanding your Personality type -- what has personality type

got to do with been a better currency trader? It has a lot to do with it. For

instance, I as a person love to do other things while trading. How then was I

able to do this? To answer this question, I’d like to state that I often see

people sitting down all day long trading forex from morning until night time. This

is a very wrong practice and this is why many so called traders fail when it

comes to trading.

Sometimes,

I felt that people just want to be called a forex trader. I seem not to

understand why. Because, I don’t see any reason why a reasonable person who has

spent his/her entire life working would give the market their money just like

that.

Are you one of these people? I strongly believe you too have burn out

your trading account more than once or twice… right?

Well

it’s good you are here to learn and discover the reason(s) why you fail as a

forex trader. with that said, as the topic suggest... I will be giving you 12

fundamental trading principles that will help you to be able to come up with

your own strategies that will help you become a consistent and profitable forex

trader.

Let’s

get started...

What

are the things you need to learn in order for you to become a better and

profitable forex trader? What am about to show you are the keys to understanding forex... if you have get a good grasps of these things, I tell you will

definitely become a better and well-informed trader. Also, these are what the

professionals use to trade.

Do

you think professional or institutional and bank traders would waste their

precious time trading their port-folio with a trading system developed by one

unknown person who is not even a trader? If you think so, you will be wasting

your time my friend.

12 foundational principles you must

know in order to be a successful trader

|

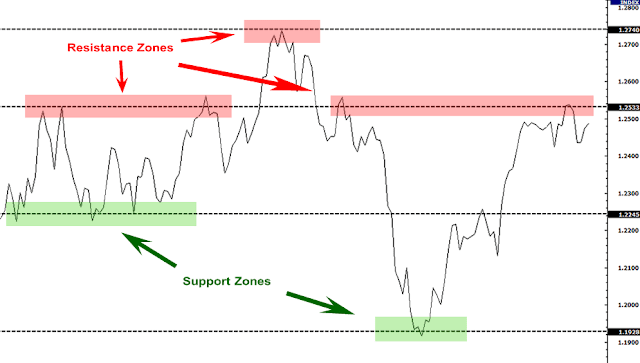

| Support and resistance gotten from babypips |

Support and

Resistance

Have

you ever heard people talking about market structure? I hear people talking

about it on a regular basis... and it has become defector words these days even

amongst beginners who know nothing about trading.

So,

what is market structure?

Marketstructure is the movement of price over time -- which could either be upward,

downward, or sideways movement. And it could be identified by the trough

(height and low) and crest which price has made over time.

If

this is so, how then do you trade market structure? These are where

understanding "support and resistance" comes into play. Support and

resistance helps to take advantage of price movement quickly. If you truly

understand “Support and Resistance,” (S&R) like the back of your palm, you

definitely become a consistent and rich trader!

Is

this not against traditional forex trading strategies or techniques? It has been

against it. There is nothing that could be compared to trade pure support and

resistance. To me, S&R are the best way to trade price action and better

understand the market structure.

Let

me let you in on a secret. Knowing support and resistance will enable you with

super knowledge of market movement... and you will be able to trade any kind of

market. Be it a trending market, and a range bound market. With support and

resistance, you are good to go. I call it the Swiss knife to trading.

Candlestick

Analysis (patterns & formations)

Candlestick

is the interpretation of price itself. One thing candlestick helps you with as

an investor is for you to be able to interpret emotions, and fears of market

participants. The candlestick gives you information you need to know such as:

open, close, high, and low prices. These information can then be plotted

against each other over time that’s the reason you see different kinds of

formations of these candlesticks.

There

are different kinds of patterns and formations of candlesticks. If you

understand these patterns or formation, you will definitely have an edge over

most traders out there... trust me on this. There are numerous candlestick

formations which I would like you to master... and they are: doji, shooting

star, hanging man, hammer, inverted hammer, spinning top, and wave candle.

While

on the other hand, you must also understand candlestick formations like: double

top & bottom, head and shoulder, triple top and triple bottom. These are

the basics you need to know to get started and along the way, you will learn

more and get used to more advanced techniques.

Howbeit,

don’t be fooled by the simplicity of these candlestick formations and patterns.

Some people just like to complicate things, you can take a look at the chart

below... are you comfortable with this chart? I doubt so.

Why? Because, this

can lead to analysis to paralysis. By the time you start getting conflicting

signals you will end up getting frustrated and confused.

This

is why many give up trading and tells you that forex is scam... whilst others

on the other end of the spectrum keep following the same vicious circle. How

could some burn out their hard-earned money just because they want to get the feel

of been called a forex trader.

This

is how I see it. Please don’t tell me otherwise. If not, you would have taken

your time to really learn how to become a better and profitable trader. Learning

is the key to trading successful. Here is a free and paid resource to learn forex trading effectively. The free resources for forex trading strategiescan be gotten here and the paid? I would recommend forex candlestick made easy. Go here to learn more about it here.

|

| Trendlines image gotten from stockchart |

Trend lines

Trend

lines are also support and resistance line but in vertical (Slant) order. One

thing about trend lines is that they give you either buy/sell zones to trade as

a trader. The beauty is that it can be used on any kind of port-folio like:

stocks, commodities, futures, and even equities as well. When combined with

oscillator indicators it becomes a very powerful trading tool in the hand of an

experienced forex trader.

|

| Moving average |

Moving averages

Amongst

most mechanical indicators …moving averages are the most popular. There are

many ways you can trade using moving averages. Here are some of the ways you do

that: moving average cross over, using it as a dynamic support and resistance. Howbeit,

most strategies adapted to moving averages are totally based on crosses. See

the charts below that illustrates how these moving averages are been used. Learn

more about moving average systems here.

|

| stochastics gotten from babypips |

Stochastic

Stochastic

is one of the most used oscillator indicator out there. It gives you oversold

and overbought signals. To better understand how to use stochastic, you can

visit this link to learn more about it.

|

| rsi image |

RSI

Here

is another popular oscillator indicator. The RSI is also used to gauge

overbought and oversold just like every other oscillator indicators out there.

It's one of my best trading indicators when combined with candlesticks

formations and patterns, and trend lines it gives you that edge over other

traders.

|

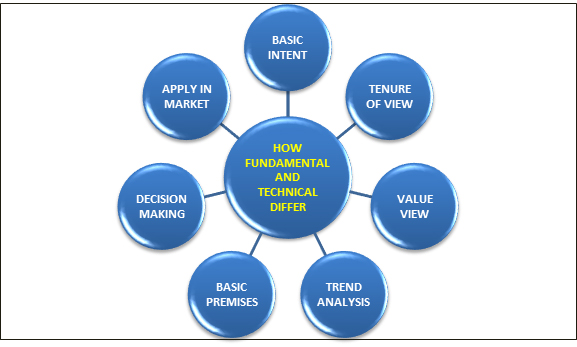

| fundamental analysis |

Fundamental

Analysis

I

hear a lot of so called traders out there saying knowing fundamental analysis

means nothing to them. That’s a wrong misconception. And many new traders

believe these so called experts. I won’t deceive you... knowing fundamentalanalysis is also a tool you need in your trading toolbox trust me on that.

Let

me ask you... what do you think makes the forex market move? What makes you

values one currency over the other? Friend, you can't be ignorant to things around

you. The bottom line is that understanding fundamental analysis is key in

becoming a profitable trader whether you use it or not. How I use the forex

fundamental is to make use of the data released on forexfactory.com.

If

there are any major news release schedule to be released at a certain time, I

take notes of these time and plan ahead of the week. During these periods of

time, there is always liquidity in the market. And you don't to sit all day

long monitoring your charts. Another interesting aspect of trading this way is

that you will be take opportunities that abound at that time.

Please

note also that time spent won’t be more than 10 hours a week trading profitably

without giving you unnecessary headache. You can learn more about fundamental

analysis from these resources.

Multiple timeframe

analysis

Multiple

time frame analysis gives you a systematic approach to carry out a top down

approach to trading. This is because, it enforce you to make use of 3 time

frames to carry out your trade analysis which gives you a bird-eye view of the

currency market. Here is a resources that enables to have grasp of how to

properly carryout multiple timeframe analysis.

|

| money management |

Money management

Have

you seen any business man who gets into business without knowing what to do? We

need to talk a little bit about money here. You can't simply ignore money

management when we talk about forex trading. I can tell that even you don’t

know about money management and if you do, have you ever done your any before?

This

why many people fail as a trader. Let me give an analogy. What most people don’t

understand is that it is normal for you to lose trades as a trader. However,

with sound money management, at the end of each trading month, your profits should

be twice your lose or even triple. This is where we talk about risk: reward

ratios. Some people go for 1:2 or 1:3 risks: reward ratio. If you properly

follow this guideline, you will definitely become profitable.

Selecting Brokers

Ah-ha

at last. The kind of broker you use could also determine if you will become

profitable and consistent trader. Many shady brokers out there trade against

their customers which is bad. In fact, I some articles on how to select good forex

brokers and how to identify shady forex broker. In these articles I went into

details on how to identify the good from the bad ones. That said, I can

recommend this forex broker to you. They are ECN brokers and are great. This is

the one i use personally as a trader.

4 Forex Trading Strategies Or System

For New Traders

My

aim is to show you that you too can come up with your own forex trading

strategies or system without you having to rely on trading systems you found

online. However, this trading system works and if you follow their rules to the

later, you will definitely see good results. As you will also notice, you will

discover that these strategies have one or more elements of what we’ve

discussed earlier on in this post. I.e. the fundamental principles of trading.

|

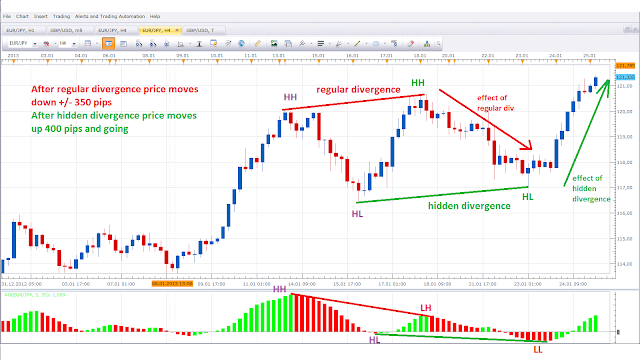

| divergence and convergence trading system |

Divergence &

Convergence

Divergence

is when price and oscillator are moving in different ways… it is eminent that

price would later move in the direction of the momentum indicator. Therefore, a

trader who uses this trading methodology takes advantage of these moves to

their advantage.

|

| ichimoku trading system adapted from tradingsim |

Ichimoku Trading

System

Ichimoku

forex trading strategies or “system” is also one of the best… however, it’s a

trend trading system and when you properly understand how to make use of it,

you will definitely see good results. The system has time frame built into it.

And above all, it gives you the psychology of the market at one glance.

For

newbie’s out there, I would gladly recommend this trading system to you.

Because it’s profitable and gives good results; you can find out to use the

ichimoku trading system by reading this article.

Moving Average

Cross Over

One

of the most popular forex trading strategies out there is the moving average

cross over. Some uses the 13, 21, and 60 E MA (Exponential Moving Average) to

trade. When the 13 crosses above 21 and both above the 60 EMA it is considered

a buy signal and vis-à-vis. There are different variations of Moving average

combinations out there. To know more about it… you can read this article on how

to trade moving average cross over.

|

| breakout trading system |

Breakout Trading

System

Breakout

trading strategies can be traded in different forms. For instance, there are

ways you can make use of moving averages as dynamic support and resistance. I

for one as made use of 20, 50, and 200 EMA to trade as a dynamic support and

resistance.

…When

price develop setups around any of the MAs be it buy or sell, I will follow

that direction. Nonetheless, I would also checkmate these setups using a

stochastic or RSI indicator. There are different ways to trade a breakout

system… here you can find some breakout system here.

The

idea is for you to demo trade anyone that looks appealing to you in one or two

months before using it on live account. Do you get it?

Summary

Tradingforex isn’t an easy task for one to engage in. However, there are systems or

forex trading strategies out there that incorporate all these I’ve mentioned so

far. If you truly want to become a better and well informed trader, you just

have to have all these elements together.

For

instance, I use pure price action trading system (forex trading strategies). My

system includes: candlesticks patterns and formations, stochastic, trend lines,

support and resistance, and I even include chart patterns as well into it.

In

addition, my multi-time frame analysis is daily, 4 hours, and 1 hour’s time

frames. More so, I uses a framework known as TLS (T=Trends, L=Levels, and

S=Setups). All my analysis goes through this process… without it I don’t take a

trade.

I

don’t take fundamentals off the picture as well. Sundays afternoon I get

prepared for the week ahead by knowing the kind of news that will be released

ahead of time and planned for it. I know the currency pairs to trade also. It

means I don’t leave anything to chance at all. This is how you should trade as

a trader you are.

For

you to become a profitable and successful trader you need proper education… and

you can get that by following this course (forexcandlestick made easy). And if you think you don’t have the money to invest

into materials, you can visit this free forex trading course here.

For

you to become a better trader you have to put all that into perspectives. Having

know all that what next? The next step is to develop a good trading system.

0 Comments